What's the best mental model to understand crypto networks? In essence, an easy way is to directly compare blockchain networks as X, Y or Z, then draw some linear extrapolation on that analogy. However, by doing so, over-simplification or overfitting become hindrances for us to map out or approach truth. The solution is to dive deeper, be more specific, gain enough context, but not be misled by trivial details.

I want to list some interesting cases(other kinds of network) as context information which enables us to view blockchains or crypto from more angles, instead of solely immersing in crypto world.

Haseeb has a good post explaining why blockchain are cities. Actually, I think if we take an object from the physical world as an analogy, the nation state will be more suitable.

However, the key point is that blockchains are opensource software, which are fundementally different from physical world mainly for following reasons:

1) The margin cost of software approaches zero, software only needs to be built once

2) The distribution cost of software approaches zero, software can be downloaded millions of times within days

Therefore, I will only discuss software platforms in this article, and try to infer the endgame of blockchain(more specifically, smart contract platform) evolution. Will the future be a multi-chain world, or be a duopoly or even oligopoly market which one or two platforms take over 90% of the market share in terms of market cap or platform revenue(txn fee)? Let’s start from how other software platforms grow, scale and evolve towards a steady state.

Ridersharing industry

The two-side network effect of ridesharing platforms is like, the more riders the platform has, the easier for drivers to get ride orders and it attracts more drivers. On the contrary, the more drivers the platform has, the easier for riders to get a ride in a short waiting time and it attracts more riders. Theoretically, if we just push this logic to the extreme, the conclusion is there will be only one ridesharing platform in the US. Obviously, it's wrong since the general logic conceals and over-simplifies the nuances in reality.

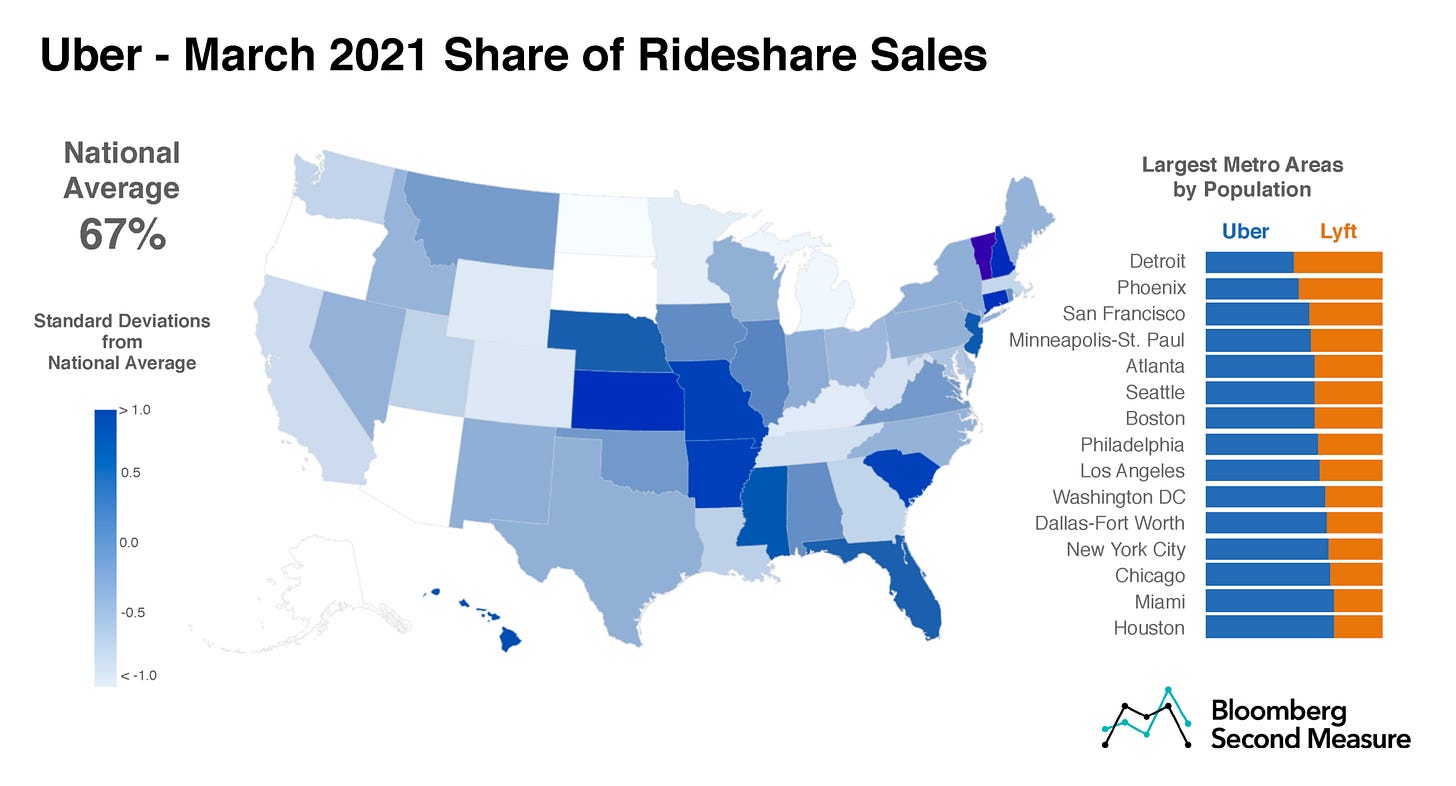

Actually, the ridesharing industry is a duopoly market with two big players Uber(~70% market share in terms of sales) and Lyft(~30%). Also, Lyft is more popular on the West Coast and Uber has a stronger dominance on the East Coast, which shows that geographical location is an important factor affecting product adoption

(source)

So why is the ridesharing market a duopoly market? Possible reasons here:

1) Network effects

1) Large platforms have economies of scale which can overpower small players

2) The customer needs are simple: 1) comfort and secure, 2) short ETA (estimated time of arrival), difficult to build competitive differentiation

So why is the ridesharing market not an Oligopoly market? Possible reasons here:

1) The networks of riders and drivers are fragmented. For example, New York is a sub-network, San Francisco is another sub-network and actually every city is a sub-network. Such fragmentation weakens the network effects, since the booming of one sub-network cannot benefit other sub-networks due to physical separation. Such complexity actually leave space for competitors to innovate.

2) Network Operation is arduous. Uber's operation team constitutes the largest portion of the company and has made the biggest impact over the years and Uber describes itself as an "Op-led" company. Operation team grows riders and drivers the hard way—coordinating street teams that handed out discount cards next to train stations—and reacted to the constant treats of regulation and competition.

3) For both riders and drivers, there is a natural need to diversify the platforms they rely on to avoid the lock-in situation.

Online dating industry

Dating apps are also network effects–driven products that usually grow city by city. The network effect here is that the more people join the network, the better the chances that people will find matches. The current dating app market in the US is still more like duopoly, with Tinder taking over ~70% and Bumble taking ~20% market share.

(source)

How does tinder grow to today's scale? Tinder starts from USC, and expands college by college, then city by city and finally becomes popular across the U.S. This process is also operationally intense as the operation teams need to organise events to disseminate the products. In addition, it requires to simultaneously attract multiple segments of users, at the right proportions, at the same time. At least in the heterosexual version, it is a two-sided network of men and women that must be built and scaled up to exactly the right ratios. Not too many ladies, and not too many guys, either, at similar levels of interests, demographics, and attractiveness, to ensure that everyone has enough matches. Thus, we still see the necessity of a centralized intervention.

Such duopoly market because of network effects is understandable. So why is the online market not an Oligopoly market? Possible reasons here:

1) The operation of online dating is complex, the intervention and assistance of the operation team is necessary. As mentioned above, only when the metrics including gender mix proportion, demographics, attractiveness, and geographical distribution are well-tuned, can user be satisfied and stick to the platfrom

2) Online dating app platform is a highly diversified and customerized business. Similar to the food Industry, people's needs and preferences for dating and love are intrinsically diverse, which adds a myriad of complexity to operation.

3) People like the freshness and experience provided by new platforms, or they believe using two platfroms could find matches faster(while three or more could be distracting).

Social network industry

Social networks are one of the most representative examples of network effects. However, the monopoly of platform is a tricky problem since there are lots of verticals. In terms of platform revenue or active users, it's hard for one or two platforms to gain monopoly. Possible reasons:

1) Different users have preference. For example, some of the younger generation prefer to use Whatsapp, while the middle aged generation may prefer Facebook.

2) There are vertical segmentations about platfroms(user needs are diverse). For example, Linkedin is used for career networking, Twitter is used for public issues discussion, Instagram is used for photo sharing. Different platforms have very clear function value propositions.

An interesting example is Wechat, it's well-known for "Super-App" which means you can almost do everything you want on WeChat including messaging, photo sharing, online shopping, life payments, short videos, text content posting and so on. Considering such a long list of functions layered on WeChat, it gains absolute dominance(oligopoly) in China. Simply put, you cannot live without WeChat in China literally.

(source)

Operating system

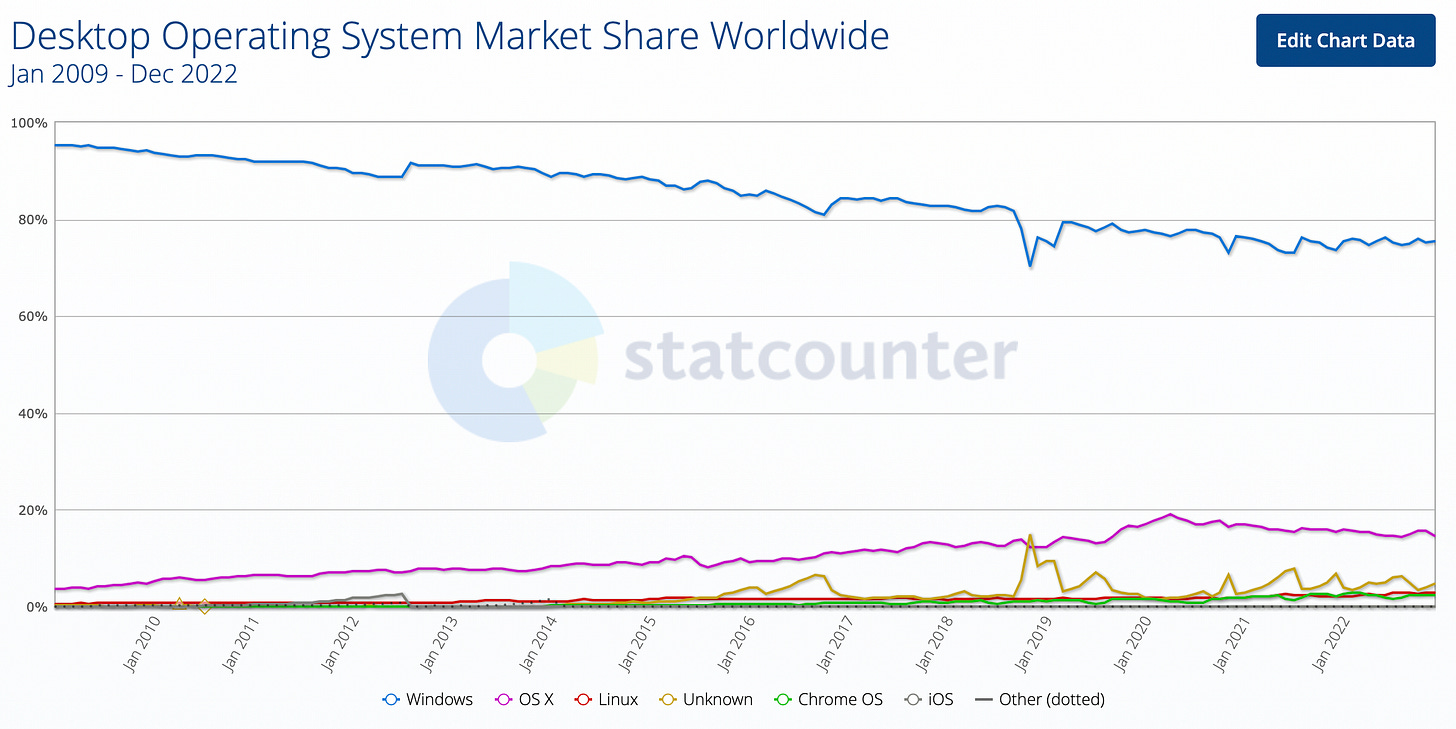

The desktop operating system market is in a very clear duopoly, while Windows takes ~75% of the market share and OS X takes ~15%. A complex software platform has a natural tendency to evolve towards monopoly. Simply, the network effect is that the more applications built on an OS, the more users will choose it. On the contrary, the more users an OS has, the more applications will be built on top of it(developers' natural choice).

(source)

To get intuition about how strong the network effects are, consider: 1) Microsoft Office 365: A comprehensive tool set(Excel, PowerPoints, Word, Onenote, One Drive, Teams...) for productivity in daily business. For enterprise users, these tools are indispensable and already deeply rooted into business workflow. 2) Developer tools: various software development environment like VS code. 3) Game ecosystem: Platforms like Xbox and Steam are decisive for game players 4)...

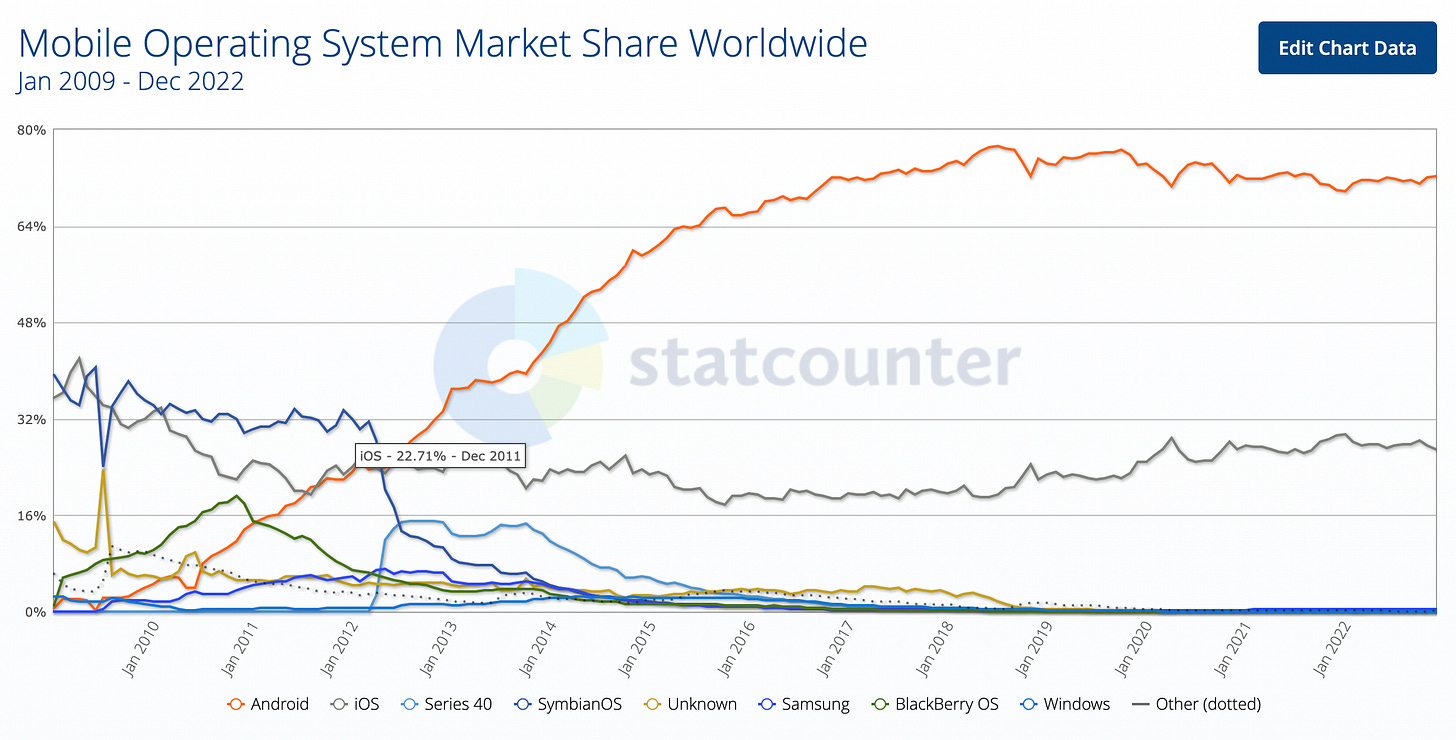

It's clear, any attempts to build a new OS to compete with Windows are crazy. Most importantly, users will only run one OS on their devices as hardware resources like computing and storage are limited. The same logic also works for the mobile OS as Android and iOS steadily dominate the mobile market with 72% and 27% market share respectively.

(source)

The core argument here follows simply from repeated application of the network effects logic. Any particular cluster of network effects may well be locked in so that a direct replacement, even a substantially superior one, is locked out. If the systems benefiting from the network effects keeps the technical level of its product reasonably close to the best available alternative, disruption would have to come from a very rapid rate of improvement in alternatives, rather than the accumulation of those improvements. This is the real moat.

Smart contract platform

Let's review the basics about smart contact platforms(we only consider Layer-1 in this post).

Blockchain is a protocol, software and a set of rules and code run by decentralized validators or miners. If we distill the system to fundamental level, there are only two roles: validators and users. The basic business model is as following:

Blockchains hire validators and miners to secure the blocks and transactions by offering blockrewards and transaction fees

Blockchains sell blocks to users, transaction fees are revenue

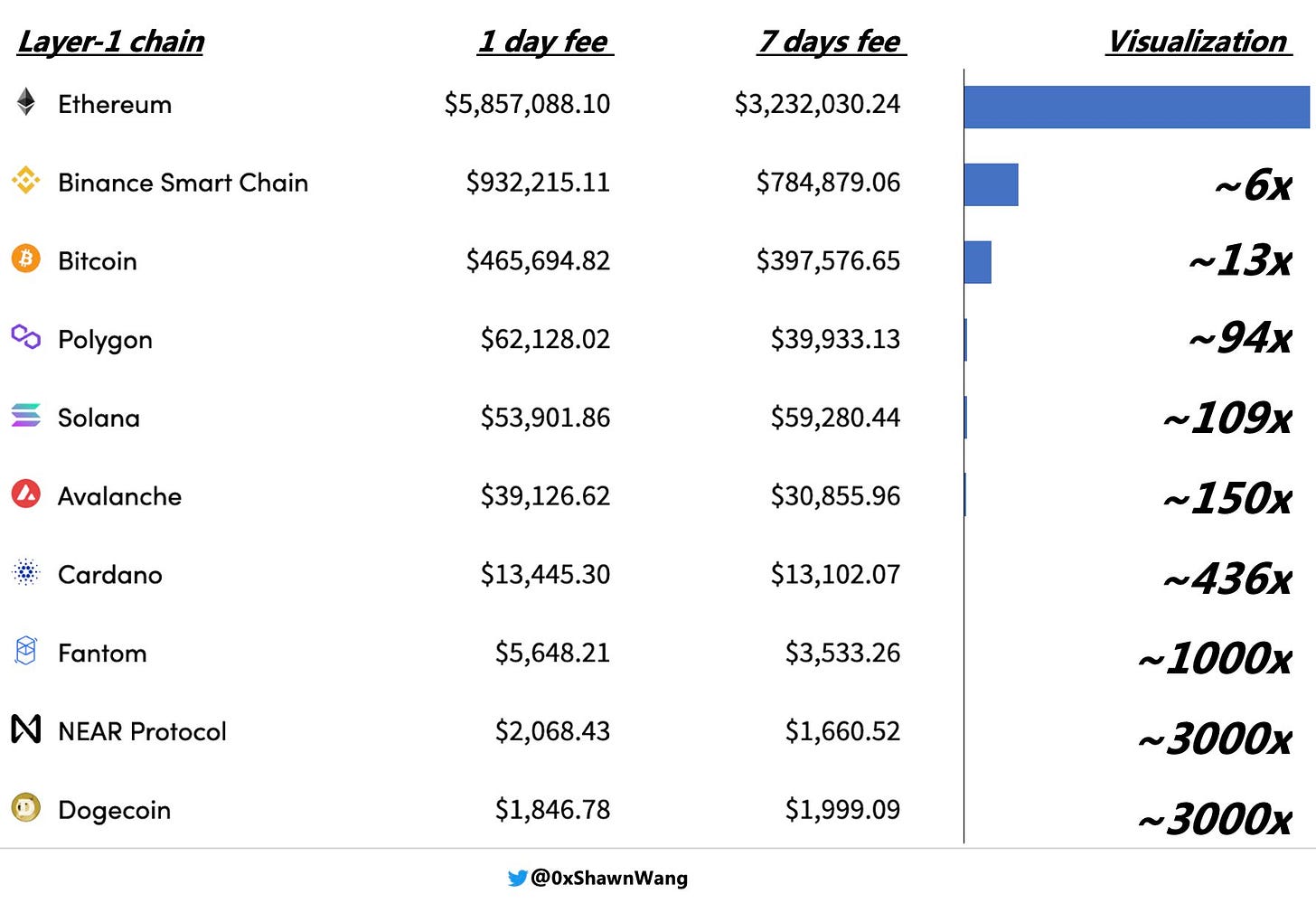

Sales revenue of blockchain is on-chain transaction fees indicating the demand for blockspace from the market. People pay more attention to market cap share distribution among Layer-1s but the fees(revenue) share is more informative.

Ethereum takes ~20% of crypto market cap while it takes ~80% of aggregated transaction fees of Layer-1 chain, which reflects real economic vibrancy, especially for smart contract platforms. The above figure shows Ethereum's revenue is over 100x more than solana and Avalanch(just assume there is no fake transactions), so-called "Ethereum killers" are ridiculous from data and Ethereum is the absolute "best seller" of blockspace. It’s known to all that gas price of Ethereum is a long-lasting headache for users. But let's be clear, it means users are fiercely competing for blockspace, which means their expensive on-chain activities are profitable for them. If blockspace is scarce and useful, the high price is inevitable.

Network effect is also a buzzword in crypto space. But let's examine what it really means for Ethereume

Solidity / Vyper: The 2 main smart contract programming languages which have large toolchains (e.g. Ethers, Hardhat, dapp, slither) built around them.

Ethereum Virtual Machine: The most popular blockchain virtual machine to date, the internals of which are understood much better than any alternative blockchain VM.

Go-ethereum: The dominant Ethereum protocol implementation which makes up for >75% of the network’s nodes. It is extensively tested, fuzzed (even finding bugs in golang itself) and as many would call it: “lindy”.

Also, Ethereum is the only blockchain has client diversity

Developer amount: Ethereum has the biggest developer community with about 4000 developers, which is 3 times more than the second large community like Cosmos or Polkadot.

2) Application ecosystem

All the high-profile DeFi protocols emerge from Ethereum including MarkerDAO, Uniswap, Compound, Aave and so on

Ethereum takes over 50% of the on-chain TVL(most are highly liquid assets like ETH) in the whole smart contract sector

Top-tier NFT projects like Bored Ape Yacht Club and CryptoPunk are built on Ethereum

Economic bandwidth: ETH acts as a native asset supporting all on-chain economic activities(like trading pair and collateral)

3) Powerful infrastructure support

Lots of third party API or node service providers like Infura, Alchemy, Chainstack, QuikNode, or Blast

All mainstream wallets have integrated Ethereum network

Multiple off-chain scaling solutions: There are different Optimistic Rollups, ZK Rollups and sidechains like Polygon

4) Decentalization(the most important feature!)

I have an article discussing this problem in detail.

The above mentioned points are not exhaustive but helpful to provide the context. All those competitive advantages compared with other smart contract platforms are self-reinforcing.

Compare smart contract platform and OS

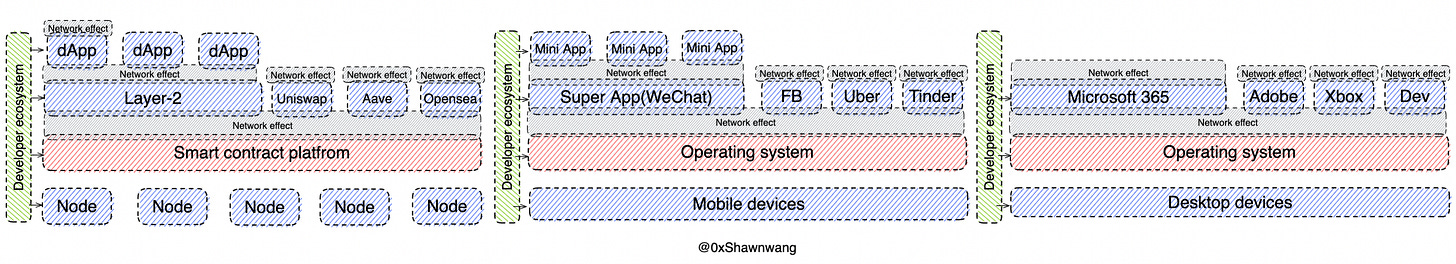

The following graph presents the similarity between smart contract platform and OS(The network effect showed below may not completely comply with the original definition, but it still has sort of accumulating advantages or increasing advantages).

Simply put, smart contract platforms and OS are both networks of networks, while most apps are just one layer of network(except for super-apps like WeChat).

For Smart contract platform, two aspects are reinforcing with each other:

At application level: dApps have internal network effects. For example, Uniswap has the most liquidity which means better trading experience and attractiveness to users. On the contrary, Liquidity providers prefer the biggest trading venue since more fees could be generated. dApps also have external network effects(or composability). For example, liquidition of lending protocols can integrate with Uniswap. The boom on appliction level stimulate the progress in platform level.

At platform level: Ethereum is the most well-understood smart contact platform. There will be dozens of technical solutions addressing the same problem, which significantly accelerate the protocol iteration. For example, the scaling conundrum of ethereum could be alleviated by lots of on-chain or off-chain solutions. In reverse, advanced performance of platform nourish the prosperity of application ecosystem.

The application explosion on OS happened 10 or 20 years ago and reshaped the world we live in today. Crypto is still young, the applications we see today may be just like prototypes. We can try to combine with other networks explained earlier to conclude the most possible endgame of layer 1 chain. Some key unique characteristics of blockchain:

Global market: Crypto is borderless and has a global user base from day one. There are no additional friction layers including financial, legal and regulatory policies which hinder traditional apps from gobal adoption. In Web2, Douyin is for Chinese users and Tiktok is for Global users, while they are the same product. Even for OS, the versions could be different(Microsoft cannot capture value from pirated software). In crypto, there is only one Ethereum in the world.

Decentralization

1) Blockchains and dApps are just opensourced software, there is no single entity having power and responsibility to operate the blockchain, antitrust actions happened in Microsoft and Standard Oil will be history, it all depends on the free market

2) There is no such thing called "operation team" we have seem in Uber and Tinder, the prosperity of the blockchain doesn't rely on subjective and proactive intervention but the emergence of the network

Platfrom not application: Blockchains have certain functions like transferring native assets, but the primary potential is being a platform hosting thousands of dApps on top of them. The fat protocol thesis also elaborate this point.

Permissionless: Users don't need any permission from authorities to use blockchain and dApps(run nodes or on-chain activities).

The similarities of OS and smart contract platform indicate the endgame could be duopoly, this has been proven by the cases of Windows/OS X and Android/iOS. The more interesting is will the future be oligoply or duopoly(if we zoom out on the time horzion), my prediction is it has a high chance to be oligopoly(Ethereum). The main arguments are as following:

1) Blockchain networks possess strong network effects similar to Operating system

2) Blockchain networks have less limitations than company’s products(compliance ,regualtion, legal issues, etc.)

3) Blockchain networks are completely digital and have no relation with operation process in with physcial assets

4) Ethereum is already an established incumbent, it’s an elephant in the room

5) Decentralization and security matters a lot, but the bootstrapping from zero is hard for both PoW and PoS.

If other smart contact platforms aim to compete with Ethereum, they need to have very special value propositions, instead of claiming single dimensional increment like higher TPS or faster finality.

Thus, the conclusion is that blockchain(smart contact platform) space has a high chance of becoming a oligopoly market which one platform(Ethereum) takes over 90% of the market share in terms of market cap or platform revenue(txn fee).

Of course, this is really a long-term prediction and may take years(or even decades) to come true, as the more underlying or fundamental the logics and arguments are, the longer it takes to fully play out.

Main Counterarguments

1) Operating systems create network effects because users make a mutually exclusive decision to use one OS at the expense of not choosing another OS(You cannot run Windows and Linux on your desktop). Users will not be locked in by a blockchain since when a user interacting with distributed applications (dApps), you will never “see” a blockchain. All you will see is a web3 front end that triggers an on-chain transaction using a tool such as Metamask. All chain and token complexity will be abstracted away.

Refute: 1) Currently, the switching cost of smart contact platfroms in terms of UX is low compared with OS. However, UX is the not the only thing users care, other factors like decentralization, on-chain application ecosystem, security and liquidity also matter(even with higher weight). 2) Low switching cost is neutral, which means users from other smart contact platforms could also easily switch to Ethereum in reverse(in this case other platforms educate the market from Ethereum).

2) With any two smart contract platforms, tokens can roam across chains. ETH tokens will not be bound to the Ethereum chain and ehe cross-chain protocols will come to place.

Refute: 1) Cross-chain actions are dangerous, billions of assets have been hacked. Although there are lots of protocols devoting to bridging assets, this tech is still early and unproven. 2) Cross-chain mechanism is hard to scale and has some intrinsic problem(hacks on a chain will harm other chains, there are ripple effects). 3) If there are a strong cross-chain needs, rollups are actually the most secure bridges

3) The execution environment or virtual machine of a single smart contact platform is limited, EVM has lots of technical flaws(like non-upgradable contracts and inability of parallel processing). Different dApps could be better satisfied by customized VM.

Refute: 1) The customized execution environment(like Fuel) could be deployed in Ethereum Layer-2s, the design space is open and they could inherit security from Layer-1. 2) Building around Ethereum enable developers leverage existing toolchain and resource(If we look at computer design field, just like Jim Keller said:”x86 is the worst architecture technically, but it’s one of the most popular architecture on this planet ”, pure tech is not decisive).

4) Ethereum is expensive and slow.

Refute: Lots of on-chain(sharding and dank-sharding, etc.) and off-chain solutions(different kinds of rollups and validum, etc.) are advancing.

Welcome feedbacks and more counter-arguments!

awesome article