Application-specific blockchain thesis: step by step from whole picture

Dive into the concrete contexts and details to evaluate app-chain

App-chains have the potential to become the next mega-narrative in crypto and extend out a whole new territory for space. But first let's dive into the current status of a high-level basic blockchain landscape and figure out various features of different types of blockchain. The theme of this post is about app-chain but it's necessary to keep the big picture in mind, so that we can suitably fit the app-chain thesis in.

The following content of this post will unpack in a way like the graph below, which is about four core properties of blockchain and a basic blockchain category. The comparisons here are not absolutely accurate but present basic trade-offs and charateristics of various chains.

Uiversal L1 Chain (monlithic)

Universal L1 Chain is a blockchain served as universal platform for diverse applications built on top of it. All basic functions including consensus, transaction validation and execution run internally within a blockchain network.

Examples: Ethereum, BNB chain, Polygon, Solana, Avalanche, Cosmos, Fantom, Harmony...

Security: Most universal L1 has high security because of scale. The network value is much easier to bootstrap since it has a broader vision and more ecosystem participants contribute to the network. Currently, universal chain has stronger security. E.g., Ethereum has over $18 billion staked in network for security, BNB chain has over $6 billion staked, Avalanche has over $4 billion staked, Solana has over $6 billion staked (considering most unlocked token is also accounted, the staking value is far less solid than Ethereum). Huge amounts of value staking on networks increase malicious attack costs as attackers have to control 51% or 2/3 staking value. But, overall, universal L1s are secure in the vast majority of cases.

Scalability: It depends on the technical architecture of blockchain and has more nuances. Ethereum L1's scalability is notorious with a 15 TPS and even hundred dollar gas cost. This flaw limits all use cases requiring high frequency transactions. All other high TPS L1s including Solana, Avalanche, BNB chain and Polygon trade decentralization (running nodes on consumer-grade hardware) for scalability due to the constrains of scalability trilemma. The key conflict of universal L1 spins up around striving for TPS and ethos of decentralization.

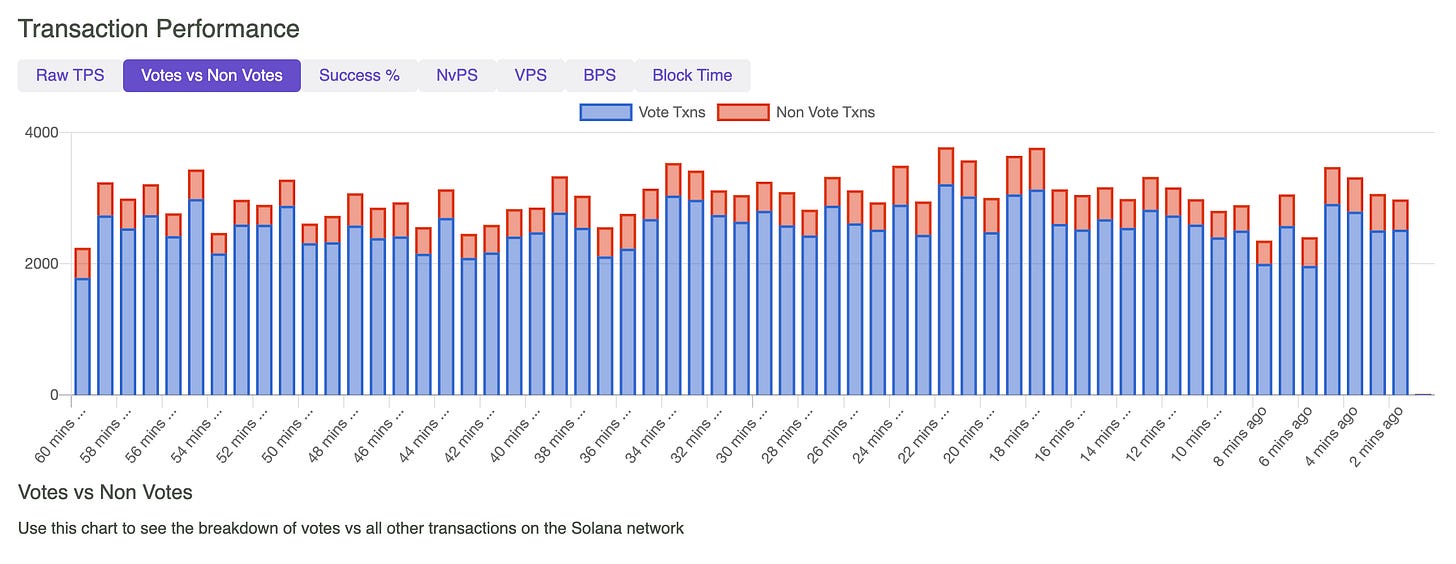

However, even for high-tps chains, scalability issues still exist like Solana's downtime triggered by popular NFT minting. Further, Solana's real TPS is around 3000 ( but even 710000 TPS in whitepaper) and over 90% of transactions are vote transactions (validator communication) instead of organic transactions (following chart). Honestly, the organic TPS should be around 300 (3000 * 10%). Thus, the valid TPS of those high-tps L1s could be actually a questionmark.

Composability: Native and atomic composability is the biggest advantage of the universal monolithic chain, since this feature paves the way for "network effects" or positive feedback loops within the ecosystem. Builders no longer need to reinvent the wheel when they have existing building blocks to employ. Universal L1s' atomic composability enables complex and multi- step transitions like flash loans.

1) Horizontal Composability: It refers to the number and type of applications on universal chains are diverse.

Examples: Uniswap is the most important and famous DEX in crypto with over $1 trillion cumulative transaction volume. However, over 80% of volume is from back-end smart contract calls (via aggregators like Matcha/1inch and arbitrage bots) and only 20% is from direct user trading on front-end interface. Also, the composability of on-chain protocol can scale infinitely and integrate with countless other dApps. All kinds of trading related functions in other dApps like DAOs, lending protocols could utilize Uniswap to swap and liquidate.

2) Vertical Composability: It refers to the interactions between applications are tightly-coupled, frictionless and fast.

Examples: Universal L1s can achieve atomic composability. Flash loans utilize this feature to maximize capital efficiency. Atomicity means either all sub-actions within a single transaction are executed, or none of them and all steps are indivisible. Ethereum L1 allows for atomic composability where several operations across multiple dApps can be bundled into a single transaction and executed together. If one of the operations fails, then the entire transaction will fail. This makes it possible to split a transaction across multiple exchanges, or vote on several DAO proposals at once without the risk of a partial failure.

Customizability: Ethereum doesn't provide customization for upper applications. Stability and super neutrality are core ethos for universal L1s, especially for Ethereum.

App-chain(applicaition-specific + monolithic)

Besides completed basic technical parts (consensus + execution + ...) like Universal L1s, App-chain is highly-customized for certain applications.

Examples: Ronin(move from Ethereum), dYdX[V4](move from Starkware), DeFi Kingdoms(DFK Chain, move from Harmony), Osmosis (DEX chain, Cosmos native)

Security: Generally, there are four levels of security from strong to weak: 1) L1s native, 2) inherited from L1s by data availability and fraud/validity proof, 3) shared security, 4) isolated. In the case of app-chain, it mainly involves the latter two.

For shared security: The security depends on a centric blockchain.

Example: All parachains that are connected to the Polkadot Relay Chain by leasing a parachain slot will benefit from the economic security provided by the Relay Chain validators.

For isolated security: The security of blockchain is provided solely by the application itself with its own basic components like validator set and consensus mechanism.

Example: Ronin, Cosmos chains (like Osmosis)

App-chains employ PoS mechanism in most cases and they always have cold-start problems. The initial market cap or staking value of new chains may not be high enough to defend the network from malicious attack. If the on-chain asset value is high, the network is vulnerable since attackers have adequate motivation.

Scalability: App-chains can leverage the customizability to achieve suitable level of scalability for specific applications. The improvement is even beyond L2 solutions and Rollups with higher flexibility.

For example, Cosmos SDK enables sovereign chain develops to customize their blockchain technical features. By increasing blocksize or reducing validator number, Cosmos chain can reach over 10000 TPS. For other separated blockchains, the tailored nodes and consensus mechanism could also boost TPS performance.

Composability: Smart contracts are public on universal L1s like Ethereum can be thought of as open APIs for other applications and it's for sure a huge edge. However, to some extent, the real demand for composability of app-chains is still unclear since a cross-chain future is vague and uncertain in far future (note, multi-chain != cross-chain). For example, Vitalik believes the future is not cross-chain.

Cross-chain composability has 2 layers of friction:

1) Assets cross-chain: barriers here: a) introducing additional UX learning cost for normal users, b) adding new trust assumptions and attack vectors and lowering security, lots of bridges were hacked in the past, c) liquidity is scattered and isolated

2) Smart contract call: a) cross-chain smart contract interactions are more complicated by design, b) cannot achieve native atomicity, c) hard to scale (the complexity may grow exponentially when more chains are involved), d) cannot support synchronous interoperability

Nonetheless, the current market does have a strong demand for cross-chain. Around $15 billion is locked in bridges and such demand should always exist for years. Overall, the composability of app-chains is relatively weak.

Customizability: App-chain has the highest customizability since developers could design all parts of blockchain to match the functions of the application.

Example: Cosmos SDK, Polkdot substrate and Polygon Edge all provide developers with the whole toolkit of building blockchains, lots of backchain features are conveniently customizable.

Osmosis is a PoS blockchain with a decentralized exchange application enabling users to provide liquidity and swap. It serves as an automated market maker (AMM) and provides cross-chain trading experience within Cosmos ecosystem(with IBC and Tendermint core). I will explain more details later.

Universal Rollup

Universal L2 scaling solutions addressing the scalability problem of underlying L1 (we only discuss Rollups built on top of Ethereum). Currently, it’s still hard to use ZK to build a univeral Rollup or zkEVM (universal ZK-Rollups), but the industry is working on that direction.

I won't unpack other scaling solutions here and focus on mainstream rollup. Following is a clear definition of L2 from Vitalik

There are many possible schools of thought on this. My personal preference would be to keep the term "layer 2" restricted to things with the following properties:

1) Their purpose is to increase scalability. 2) They follow the "blockchain within a blockchain" pattern: they have their own mechanism for processing transactions and their own internal state. 3)They inherit the full security of the Ethereum chain

Examples: Optimistic Rollups(Optimistism, Arbitrum), ZK-Rollups(StarkNet)

Security: The gist of rollup is to inherit security from underlying L1 through data availability and fraud/ validity proof. The compressed version transactions and state root will be posted and settled on L1. This is the fundamental difference with sidechain or other scaling solution.

A layer 2 has a security guarantee that depends on the main chain only. That is, if you have coins inside a layer 2, then as long as the main chain keeps working you are guaranteed to be able to covert those coins into coins on the underlying main chain; even a 51% attack on the layer 2 cannot prevent you from converting. In a sidechain, this is not the case; a 51% attack on the sidechain can steal the coins inside the sidechain. By Vitalik

Scalability: Currently, Rollups could improve performance of Ethereum (15TPS) by 2 or 3 order of magnitude. Here is a brief summary (note, this is a highly theoretical estimation, if you look at current real performance, it's far less than the following number. Theoretical bounds really only make sense in the context of a well-defined problem space):

ZK-Rollup(ZRU): Normal TPS = ~4000, Max TPS(simple trasaction)= ~12000, Max record(real) = 868

Optimistic-Rollup(ORU): Normal TPS = ~500, Max TPS(simple transaction) = ~1500, Max record(real) = 292

Further, EIP-4844 has the potential to contribute another 100x improvement to current Rollup scalability. The purpose of listing such TPS is to gain a basic sense of scalability improvement, while real TPS performance also depends on market demand for blockspace.

Composability: The composability of Rollup is the ability of smart contracts on different Rollups to interact with each other. In essence, Rollups are also separated blockchains but all taking Ethereum L1 as settlement layer. Thus, Rollups face obstacles like app-chains similarly (go to above app-chain parts). A key difference is all Rollups have a unified settlement layer which provides some common design space at least and it should be better compared with app-chains.

Example: dAMM built on StarkWare is a cross-L2 DEX but it's immature, this space needs further exploration.

App-Rollup(applicaition-specific rollup)

App-Rollups are solely designed from certain applications.

Examples:

1) L2 App-Rollups: dYdX(ZRU, derivative exchange), Aztec(ZRU, privacy payment), Immutable X(ZRU, NFTs marketplace).

2) L3+ App-Rollups: Almost no concrete examples and it's in development currently, but could open up main narrative in future.

Security: Generally, it's almost the same as Universal Rollups (mentioned above). If the transaction data is posted on Ethereum eventually, it still inherits Ethereum's security even with some recurcively multi-layer settlement process (like L3--> L2--> Ethereum).

So, you build a settlement zk rollup on top of the base settlement layer. This needs to be a smart contract chain too, to enable innovative interoperability and liquidity sharing mechanisms between application-specific rollups.

So, you build a settlement zk rollup on top of the base settlement layer. This needs to be a smart contract chain too, to enable innovative interoperability and liquidity sharing mechanisms between application-specific rollups.Inheriting Security without new issuance is fundamental advantage of App-Rollups:

Scalability:

1) Economic side (supply and demand): Since all blockspace is sole for certain applications, UX is superior than univeral Rollups.

2) Technical or engineering side: highly context-dependent while the lower bound should be same as universal rollups (mentioned above).

Composability: Generally, it's almost the same as Universal Rollups (mentioned above).

Customizability: Recently, both ZRUs camp and ORUs camp have rolled out their future plans and visions covering customization or modularity. Although it seems like infancy, we do get a glimpse of future. Two examples:

Optimisim's OP stack: It’s a series of modules that work together to form coherent, reliable blockchains. Each of these components implements a specific layer of the stack. Each layer of the OP Stack is described by a well-defined API, to be filled by a module for that layer. You can easily modify existing modules or create your own entirely new modules to fill the needs of whatever application you’re building

zkSync L3 "Opportunity": zkSync’s Layer 3 provide different levels of data avalibility(zK Rollup, ZkPorter and Validium). Developers further customize their fractal HyperChain for the following: 1) Privacy will be entirely customizable, 2) Tokenomics, aligning incentives, 3) HyperBridges (native secure bridges)

Summary

Fundamentally, the whole crypto space expands in two directions: either horizontally, or vertically. The key differentiator here sits on "inherited security", more specifically, whether you need to post transaction data (compressed version) on Ethereum. This problem also split the design space and evolution path of app-chain and app-rollup. The following vistualizaiton offers a basic overview.

App-chain Case study

dYdX

dYdX is the largest decentralized derivative exchange with over $1 billion trading volume and 38 trading pairs. The migration paths and considerations behind are as the following:

Ethereum L1 --> StarkWare(Apr, 2021):

1) Why choose L2: a) scalability of Ethereum L1 is almost unsolvable in the foreseeable future, L2s could scale TPS by order of magnitutde and charge lower trading fee(no gas fee), b) Other Layer 1s do not yet have the collateral base and building blocks such as wallets and developer tools that have made Ethereum successful

2) Why choose StarkWare (ZRUs not ORUs): a) ORUs are potentially good but not yet battle-tested (at that time), b) withdraw time of one week hurts UX, c) ORUs cannot offer the same level of decentralization & cryptographic guarantees as ZK-Rollups

StarkWare --> Cosmos (Jun, 2022): dYdX V4 will be developed as a standalone blockchain based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol

1) Technical performance: The fundamental problem with every L1 or L2 is that none can handle even close to the throughput needed to run a first class orderbook and matching engine. For reference, the existing dYdX product processes about 10 trades per second and 1,000 order places/cancellations per second, with the goal to scale up orders of magnitude higher.

2) Customizability: Cosmos offers full customizability over how the blockchain itself works, as well as the jobs that validators perform. In dYdX V4, each validator will run an in-memory orderbook that is never committed to consensus (i.e., off-chain). Orders placed and cancellations will be propagated through the network similar to normal blockchain transactions, ensuring that orders placed and cancellations will always make their way through the network. The orderbook that each validator stores is eventually consistent with one another. Such features are hard to achieve in L2s.

3) Full sovereignty: dYdX chain is not reliant on any external blockchain or system. It is a platform for the dYdX community to continue to build in a vertically integrated way with the protocol token holders fully controlling the system. Whether it’s building additional features like spot trading, options, or multi-collateral or improving core underlying technology the dYdX community control every aspect of the stack and can build the best possible product experience.

3) No trading gas fees: Traders would not pay gas fees to trade, but rather pay fees based on trades executed similar to dYdX V3 and centralized exchanges. These fees would accrue to validators and their stakers.

4) Better decentralization: The goal for V4 is to enable the entire product maximally decentralized and performant. The decentralization of a system is defined by its least decentralized component. Ethereum based L2s have two issues: a) both they are not close to performant enough to power dYdX (“Off-chain, decentralized, orderbook + matching”), b) currently they operate through central sequencers which have the ability to censor transactions.

5) Preference to open source(reduce dependence): StarkWare uses closed source code and a different programming language(called Cairo). Cairo is the native smart contract language for Starknet and StarkWare, allowing for zero knowledge Rollups. One of the issues between dYdX and StarkWare is that essentially dYdX was using stark technology (StarkEx) “as a service”. dYdX needs to pay fees to the StarkWare team off-chain, and the StarkWare developers wrote all of the code. If StarWare team no longer provide enough support, dYdX's operation will be affected.

The following comments comes from founder of dYdX:

Osmosis

Osmosis (launched in Jun, 2021) is the biggest DEX in Cosmos ecosystem and once hit over $1.8 billion TVL. Osmosis is currently linked with 48 chains within the Cosmos network. It is built as an asset hub with Cosmos ecosystem from day 1 and exemplifies outstanding customizability. Following are some key features:

1) Flexible funcation featrue design: Nothing about the underlying structure of AMMs is hard-coded. Not only are key parameters such as swap fees or token weights parameterizable for each liquidity pool, but entire components such as the curve algorithm and TWAP calculation are also fully-customizable as well. Pool creators don’t have to decide between just constant product and constant sum, but can instead input their own novel mathematical expressions. New curves can be generated on the fly and such new curves can be much more powerful than existing AMM models, which only accept token balance quantities, by leveraging data points such as time dependencies, volatility indexes, and off-chain oracles as inputs. Osmosis’ parameterizable inputs enable the creation of newer DeFi asset types like options, dynamic fee markets that adapt to moments of high volatility, work to mitigate undesirable outcomes like impermanent loss for liquidity providers (LP)

2) Superfluid staking: allowing users to simultaneously provide liquidity to the Osmosis AMM and still participate in the native ecosystems of the tokens they hold by staking. For example, an OSMO/AKT pool’s LP tokens will be able to secure both the Osmosis and Akash networks.

3) MEV resistance: It has a threshold encryption mechanism. Transactions are encrypted once they get included in the mempool (before being included in the block, which hides the transaction information and thus prevents the validators from ordering/censoring the transaction). After the transaction is encrypted, the private key used to decrypt the transaction is shared among all validators. Then 2/3 of the validators are able to decrypt it. Eventually, the block will be almost simultaneously decrypted when it’s confirmed.

There are some explanations from founders and team about Osmosis which offer us some insights abour app-chain.

"Rather than aim for a one-size-fits-all homogeneous approach for AMMs and its liquidity pools, Osmosis is designed such that the most efficient solution is reachable through the process of experimentation and rapid iteration by leveraging the wisdom of the crowd. It achieves this by offering deep customizability to AMM designers, and a governance mechanism by which each AMM pool’s stakeholders (i.e. liquidity providers) can govern and direct their pools." By Osmosis Labs

Let's go build the DEX for the Hub. We just want to be able to upgrade way faster. Like the Cosmos Hub is a much slower thing. Our goal was: we want to be able to upgrade the chain on a monthly basis if we want, that's just something that Hub doesn't do. The Hub is meant to be this more conservative chain. And Osmosis, it's a science lab, we were pushing this idea that it's meant for experimentation. We're gonna go just way faster.

On top of that, we also just needed access to much lower level stuff, like we can't do the threshold decryption, we need to go change how Tendermint works a little bit. So having our own chain is useful, it's really important to be able to move fast on those kinds of things.

Finally, obviously to bootstrap a DEX, you need some sort of liquidity mining scheme and it's really hard to build a good liquidity mining scheme on an existing token, like ATOM that's already so distributed. If we're building this DEX, we want it owned by the LPs and make sure they're incentivized and are part of the governance process. And so the best way to do that is to issue a new token that you give to the LPs.

By Sunny Aggarwal (Co-founder of Osmosis) in ZK podcast

Risks and drawbacks

Economic security: cascade effects of hacks exist. For example, ATOM is main trading pair token and if Cosmos Hub gets corrupted, lots of pools could be drained out (almost half the pools are based on ATOM) since attackers could mint infinite ATOM.

Technical security: Developing a new chain is more complex than developing a smart contract. Osmosis was halted for emergency maintenance as developers investigate the extent of a liquidity pool exploit which may lead to $5 million loss.

Ronin

Ronin (launched in Feb, 2021) is an Ethereum-linked sidechain made specifically for Axie Infinity to solve the scalability problem. The transaction experience must be seamless and enjoyable for viability and catering mass adoption of a game. The following are reasons for building Ronin:

Why not Ethereum

Basic scalability: Obviously, Ethereum is expensive and slow. At its peak in November, Ronin processed over 560% of the total number of transactions on Ethereum. While there is no official documentation on the max TPS of the Ronin network, it has a block time of ~3s (ETH averages ~13s). Executing trades on the Axie marketplace and sending assets over the network are completed within seconds.

Why sidechain

Additional user entrance(support from Binance): Users who have a Binance account are able to send Ronin AXS and SLP directly to and from their Ronin wallets.

As transactions go through the Ronin network instead of Ethereum, fees are much lower, typically costing less than $1. In the case of SLP, sending it over to a Ronin wallet costs 1 SLP ($0.03) or 1/1116 of the price when compared to using the Ethereum network.

Direct Bridging from Ethereum network is expensive and makes smaller transactions uneconomical and is a huge hurdle for most users.

Customization for accelerating adoption: a) Sky Mavis created their own Ronin wallet. The team partnered with Ramp to allow users to purchase Axie ecosystem tokens directly using fiat, b) Ronin offers 100 free transactions per wallet per day.

Why not L2s

Reduce technical dependance: Before building Ronin, the team partnered with Loom network (a Layer-2 scaling solution). However, about 1 year later the Loom team decided to optimize their network for enterprise solutions instead of user-facing applications. This created a misalignment of goals between the two teams and Sky Mavis decided to end the partnership. Building their own blockchain would prevent a similar situation from occurring in the future.

L2 solution are not mature enough(at that time): Most existing Layer-2 solutions are mainly univeral or focus on DeFi and payments, not gaming. Creating own blockchain enables Sky Mavis (team behind Ronin) to gain more design flexibility and reduce potential future scaling issues that might arise by using underlying blockchains. Other potential solutions such as zkSync using ZK-rollup were too new and did not have the proper infrastructure to cater for the needs of Axie Infinity.

Risks and drawbacks

More attacking vectors: In late March 2022, Ronin bridge was hacked and resulted in a $624 million loss which became the biggest hack in crypto rekt leaderboard

The official report from the company noted that the hackers managed to get access to private keys to validator nodes resulting in the compromise of five validator nodes, which is also the threshold required to approve a transaction. The Ronin chain currently consists of nine validator nodes and the hacker managed to get access to four of them along with a third-party validator run by decentralized autonomous organization (DAO) Axie DAO.

Centralization of the network: Ronin currently adopts a Proof-of-Authority (PoA) consensus model which is a reputation-based system that allows for fast transactions due to its limited number of validators and relatively centralized nature.

Validators are handpicked by the team based on their credibility and unlike Proof-of-Stake blockchains, validators are “staking” their reputation instead of tokens. Some examples of validators for the Ronin network include Binance, Ubisoft and Animoca Brands.

App-chain thesis question list (Not comprehensive)

User side

Why do we need to build a new blockchain instead of deploying smart contracts on existing platforms? What's the market demand?

Is there a strong demand for cross-chain functions(atomic composability)?

What's the core feature of the application? It might be reasonable to build a DEX chain since the use case is high frequency trading. It seems for applications with low usage frequency like MarkerDAO and lending protocol, users will not interact with protocol every day.

Do we need support from other ecosystems?

Developer side

Why do we need to build it today? Is the infrastructure already mature?

What's the "Go-to-market" strategy?

On-chain app--> app-chain: how to choose ecosystem? App-chain or app-rollup? Why?

App-chain from Day 1: how to bootstrap and cold start a new chain?

Is there liquidity fragmentation? How to alleviate?

How to make trade offs between unforkbility and complexity of building an app-chain?

Are development tools and environment friendly to developers?

Validator side

How to solve the economics of protocol? The essence of blockchain economy is selling blockspace, what if validators cannot even breakeven and are disincentivized? How create organic demand for blockspace?

What's the value capture rule and tokenomics? Gas currency and governance? More?

Permissonless or not? How to choose validators? Why?

Final thoughts

There is no fixed one-size-fits-all solution for neither app-chains or app-rollups. The objective function of app-chain design is a multi-factor weighted decision function containing both pros and cons. Our goal is to put it into concrete and specific context and try to maximize success probability.